Options are simply a legally binding agreement to buy and/or sell a particular asset at a particular price (strike price), on or before a specified date (maturity date).

There are two types of Options that can be bought (Long) and sold (Short):

> CALL Option: Gives the owner the right, but not the obligation, to buy a particular asset at a specific price, on or before a certain time.

> PUT Option: Gives the owner the right, but not the Obligation, to sell a particular asset at a specific price, on or before a certain time.

Options were created to manage one thing, risk. They can be used to hedge, speculate or simply as insurance. What’s important to note with options trading, is that investors should clearly define the benefits and risks of each and every position they enter into ahead of time. Although Options are important tools for hedging and risk management, traders could end up losing more than the cost of the option itself.

Below is a summary of how options function.

1- CALL OPTION:

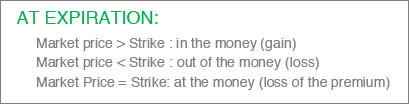

>> As a Call Buyer you:

> Acquire the right but not the obligation to buy the underlying at a certain price (strike) for a period of time

> Have to pay a premium

> Want the underlying price to increase

As a call Buyer, your maximum loss is the premium already paid for buying the call option.

To get to a point where your loss is zero (breakeven) the price of the option should increase to cover the strike price in addition to premium already paid.

Your maximum gain is unlimited as a call buyer given the fact that there is no ceiling to price increase.

What are your choices as a call buyer?

> To exercise and buy the underlying when the option is in the money.

> Trade the option also when the option is in the money.

> You can walk away and not exercise the option.

What are your two main objectives as a call buyer?

> To speculate on the potential rise in the price of an underlying instrument.

> To hedge a Short position on the same underlying.

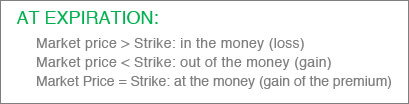

>> As a Call Seller you:

> Assume the obligation [not the choice] to sell the underlying when the call buyer exercises his option.

> Will receive a premium for that obligation to sell [from the buyer of the option]

> Will be willing to see the underlying price decreasing.

As a call seller your maximum loss is unlimited.

To reach breakeven point, the price of the option should increase to cover the strike price in addition to premium already paid.

Your maximum gain as a call seller is the premium already received.

What are your choices as a call seller?

> In case the call option is exercised by the buyer of the call, then the seller has the obligation to deliver the underlying with a potential of unlimited loss.

> If the underlying price decreases, option expires worthless and the seller will keep the premium as the maximum profit attributed to this trade.

What is your main objective as a call seller?

> To increase yield by selling calls against positions held long.

![]()

2- PUT OPTION:

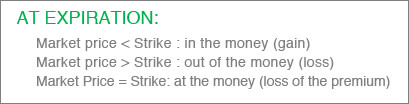

>>As a Put Buyer you:

> Have the right [but not the obligation] to sell the underlying at a certain price (strike) for a period of time.

> Pay a certain premium for holding the right to exercise.

> Want the underlying price to decrease.

As a Put Buyer, your maximum loss is the premium already paid for buying the put option.

To reach breakeven point, the price of the option should decrease to cover the strike price minus the premium already paid.

Your maximum gain as a put buyer is the strike price minus the premium.

What are your choices as a call buyer?

> To exercise and sell the underlying when the option is in the money.

> Trade the option, when the option is in the money.

> You can walk away and not exercise the option [on the option seller] when your put option is out of the money.

What are your two main objectives as a call buyer?

> To speculate on the potential drop in the price of an underlying instrument.

> To hedge a long position on the same underlying against a market drop.

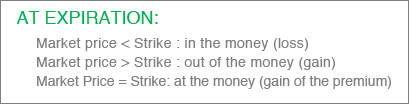

>>As a Put Seller you:

> Assume the obligation [not the choice] to buy the underlying when the put buyer exercises his option.

> For that assumption you will receive a premium [from the buyer of the option]

> Will be willing to see the underlying price increase.

As a put seller your maximum loss is the strike price minus the premium.

To get to a point where your loss is zero (breakeven) the price of the option should not be less than the premium already received.

Your maximum gain as a put seller is the premium received.

What are your choices as a put seller?

> In case the buyer of the put exercises the put option, then the seller has the obligation to deliver the underlying with a potential loss.

> If the underlying price increases, it becomes worthless on maturity date, and the seller keeps the premium as maximum profit.

What is your main objective as a put seller?

As a put seller, investors believe that the underlying stock price will rise and that they will be able to profit from a rise in the stock price by selling puts. Investors who sell a put are obligated to purchase the underlying stock if the buyer decides to exercise the option. An investor who sells a put may also be selling the put as a way to obtain the underlying security at a cheaper price. If the stock is put to the investor, the investor’s purchase price is reduced by the amount of the premium received.

RISKS AND REWARDS RELATED TO OPTIONS