INVESTORS & CORPORATES

INVESTORS & CORPORATES

KEY INVESTING CONCEPTS

All investors should understand a few essential investment concepts, including how to evaluate investment performance, asset allocation, diversification, rebalancing and the role risk plays in virtually all aspects of investing.

Learning basic investment concepts and even choosing investments is just the beginning of your work as an investor. Over time, you will want to gain a deeper understanding of more advanced aspects of investing, like how different types of risk can impact your portfolio.

ASSET ALLOCATION

When you allocate your assets, you decide—usually on a percentage basis—what portion of your total portfolio to invest in different asset classes, like stocks, bonds, and cash or cash equivalents.

You can make these investments either directly by purchasing individual securities or indirectly by choosing funds that invest in those securities. As you build a more extensive portfolio, you may also include other asset classes, such as real estate, which can help to spread out, and thus moderate, your investment risk.

Asset allocation is a useful tool to manage systematic risk because different categories of investments respond to changing economic and political conditions in different ways. By including different asset classes in your portfolio, you increase the probability that some of your investments will provide satisfactory returns even if others are flat or losing value. This is known as diversification.

Put another way, you’re reducing the risk of major losses that can result from over-emphasizing a single asset class, however resilient you might expect that class to be. This is especially true if your assets are “uncorrelated,” meaning they react to economic events in ways independent of other assets in your portfolio. Stocks and bonds, for instance, often move in different directions from each other, which is why holding both of these asset classes can help manage risk. While you can recognize historical patterns that seem to indicate a strong period for a particular asset class or classes, the length and intensity of these cyclical patterns are not predictable. That’s why it’s important to have money in multiple asset classes at all times. You can always adjust your portfolio allocation if economic signs seem to favour one asset class over another.

Financial services companies make adjustments to the asset mix they recommend for portfolios on a regular basis, based on their assessment of the current market environment.

>>Example: A firm might suggest that you increase your cash allocation by a certain percentage and reduce your equity holdings by a similar percentage in a period of rising interest rates and increasing international tension.

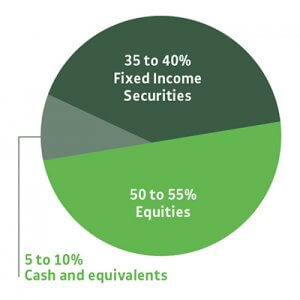

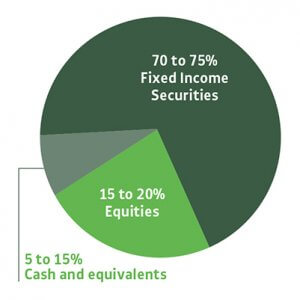

Companies frequently display their recommended portfolio mix as a pie chart, showing the percentage allocated to each asset class. Modifying your asset allocation modestly from time to time is not the same thing as market timing, which typically involves making frequent shifts in your portfolio holdings in anticipation of which way the markets will turn. Because no one knows what will happen, this technique rarely produces positive long-term results.

INVESTMENT STRATEGIES

> Growth Investment

This type of investment seeks out capital appreciation and future earnings potential through price increase. The main goal of a growth investment is to capitalize on a stock which demonstrates signs of high earnings that are well above the average rate compared to other firms in their industry and within the overall market. Instead of rewarding investors with dividends, growth stocks remunerate investors by reinvesting earnings into the company to achieve further growth.

> Income Investment

Income investment adopts a low risk/low volatility strategy where a steady inflow of income is generated into the risk adverse investor. The biggest example of income investing is the purchase of bonds and dividend-paying stocks among others.

> Capital Preservation

Known as the investment most precious to conservative investors (such as retirees or those planning their retirements), whereby investors focus on generating enough income to cover their living expenses and preserve their capital, this is a strategy for protecting the money you have available to invest by choosing insured accounts or fixed-income investments that promise return of principal and also by choosing securities that are easy to liquidate without losses when markets do not perform well; hence investments based on safe and short-term instruments.

Whatever your strategy is, make sure to create a Portfolio based on a clear investment policy.

WHY CREATE A PORTFOLIO?

A smart investment is one which aims to reach the highest possible return while aiming for the lowest possible risk. For that reason, creating a portfolio becomes essential. In order to make the best out of a portfolio, the investor should consider two important features:

> The time horizon of the investments (or investment horizon)

> Personal risk tolerance.

By understanding both factors, the investor aims to build a portfolio which is best fit to their personal goals, and well diversified to help lower associated investment risks.

BASIC TYPES OF PORTFOLIOS

An easy way to think of a portfolio is to imagine a pie chart, whose portions each represent a type of asset class to which the investor has allocated a certain portion of his whole investment.

In general, there are two types of portfolios:

> Aggressive investment strategies

> Conservative investment strategies.

The aggressive investment strategy is for those who seek the highest possible return and whom aren’t afraid to have a high risk tolerance. Aggressive portfolios generally have a higher investment in equities.

Aggressive Portfolio

The conservative investment strategy is for investors which put safety at a high priority, and who are risk averse and have a shorter time horizon. Conservative portfolios will generally consist mainly of cash and cash equivalents, or high-quality fixed-income instruments that are not speculative in nature.

Conservative Portfolio

REBALANCING YOUR PORTFOLIO

As market performance alters the values of your asset classes, you may find that your asset allocation no longer provides the balance of growth and return that you want. In that case, you may want to consider adjusting your holdings and rebalancing your portfolio.

Assets grow at different rates—which mean that your portfolio might end up out of line with the allocation you have chosen.

For example, some assets might recently have grown at a much faster rate. To compensate, you might reallocate some of the value of fast-growing assets into assets with slower recent growth, which may now be poised to pick up steam while recent high-performers slow down. Otherwise, you might end up with a portfolio that carries more risk and provides a smaller long-term return than you intended.

Although there’s no official timeline that determines when you should rebalance your portfolio, you may want to consider whether you need to rebalance once a year as part of an annual review of your investments.

REBALANCING APPROACHES

You can rebalance your portfolio in different ways to bring it back in line with the allocation balance you intend it to have.

Here are three common approaches to rebalancing:

> Redirect money to the lagging asset classes until they return to the percentage of your total portfolio that they held in your original allocation.

> Add new investments to the lagging asset classes, concentrating a larger percentage of your contributions on those classes.

> Sell off a portion of your holdings within the asset classes that are outperforming others. You may then reinvest the profits in the lagging asset classes.

All three approaches work well, but some people are more comfortable with the first two alternatives than the third. They find it hard to sell off investments that are doing well in order to put money into those that aren’t. Remember, though, that if you invest in the lagging classes, you’ll be positioned to benefit if they turn around and begin to prosper again.

AUTOMATIC REBALANCING WITH LIFECYCLE FUNDS

The asset allocation you choose to help you meet your financial goals at an earlier time in life may no longer be the ideal allocation after you’ve been investing for some time, for instance as you approach retirement.

Or, like many investors, you may simply never take the time to modify your allocations, or feel confident doing so. And so you might end up doing nothing.

That’s where lifecycle funds, also called target date funds, come in. These funds are increasingly being offered in retirement plans, and are also available to investors outside of retirement plans, too.

Each lifecycle fund is designed to have its allocation modified gradually over a period of years, shifting its focus from seeking growth to providing income and preserving principal.

Usually, this is accomplished by reducing your exposure to stocks and increasing the percentage your lifecycle fund allocates to bonds. To make matters simpler, a fund’s timeframe is often part of its name.

>> Example: In 2015, if you’re thinking of retiring in about 15 years, you might put money into Fund 2030. And if your target retirement date is 30 years away, you might choose Fund 2045.

Before transferring your balances to a lifecycle fund, you’ll want to investigate the fund as you would any potential investment, looking at its objective, fees, manager, historical performance and risk levels, among other details. If it passes those tests, it may be an alternative to consider.

Also keep in mind that lifecycle fund managers may be making allocation decisions assuming that this is your sole investment. Take the time to evaluate lifecycle funds relative to your overall investment portfolio.

CONCENTRATE ON CONCENTRATION RISK

A diversified portfolio tends to be harder to achieve than simply following the mantra: don’t put all your investment eggs in one basket.

This basic strategy can help, but it is often not enough to avoid concentration risk—the risk of amplified losses that may occur from having a large portion of your holdings in a particular investment, asset class or market segment relative to your overall portfolio.

The first step in managing concentration risk is to understand how it might occur. Concentration can be the result of a number of factors:

> Intentional concentration.

You may believe a particular investment or sector will outperform its peers or an index, so you make a conscious decision to invest more of your money in a given asset or asset class.

> Concentration due to asset performance.

Maybe one of your investments has performed very well relative to the rest of your portfolio. For instance, in a bull market, you may find your stock holdings now represent a significantly greater percentage of your portfolio than before since your stocks gained more value than your bond holdings.

> Company stock concentration.

Employees may be tempted to concentrate their retirement savings in the stock of their employer. FINRA has cautioned investors about the risk of holding too much company stock.

> Concentration due to correlated assets.

Investments within the same industry, geographic region or security type tend to be highly correlated, meaning that what happens to one investment is likely to happen to the others. For instance, you might own a variety of municipal bonds, but all of them are in the same state or region. Or you may have investments in individual technology companies but also own a technology fund and have technology stocks represented in an index fund you own.

> Concentration in illiquid investments.

Certain investments such as private placements, unlisted Direct Participation Programs and non-traded Real Estate Investment Trusts (REITS) may be difficult to sell quickly. Other investments, including variable annuities, may impose a surrender charge if you try to sell before a certain period of time. Should you need quick access to cash and are heavily invested in illiquid securities; you may not be able to tap this money in a timely or cost-efficient manner.

TIPS TO MANAGE CONCENTRATION RISK

The following tips can help manage concentration risk.

> Diversify across, and within, the major asset classes.

Do you hold multiple asset classes (such as stocks, bonds and real estate)? Are your stock holdings spread among different sectors (biotech, electronics, retail and emerging markets, to name a few)? Is your bond portfolio diversified by issuer and type of bond (corporate, municipal and Treasury), and do the bonds mature at different intervals? Mutual funds and exchange-traded funds (ETFs) can be helpful in achieving broad diversification, as can life-cycle funds, which have the added bonus of rebalancing automatically as you age.

> Rebalance regularly.

Regardless of whether you manage your own portfolio or have it managed by a financial professional, perform periodic reviews of your holdings and make adjustments to ensure it coincides with your investment objective. If you are saving through an employer-sponsored retirement plan, your plan may offer automatic rebalancing, or rebalancing assistance through the plan administrator.

> Look “under the hood” of each mutual fund or ETF you own.

Read the fund’s prospectus or visit the fund’s website to see if your funds are holding positions in similar companies, or if they overlap with any individual stocks or bonds you may own. Make use of this information as you rebalance and examine your exposure to individual investments. Also be aware that some funds can be highly targeted to specific investments such as a single commodity, or emerging markets in a specific part of the world. Just because you hold only funds does not shield you from concentration risk.

> Know how easily you can sell your investments.

Low-priced stocks, non-traded REITs and private placements may be hard to sell on short notice or at an efficient price. Some bonds, such as mortgage-backed securities, may also be less liquid than other types of bonds. To learn about an investment’s liquidity, read the offering documents or ask an investment professional. If a large percentage of your portfolio is tied up in illiquid securities consult an investment professional about potential remedies.

It’s not always easy to tell when your portfolio is exposed to concentration risk. This is especially true of portfolios that contain complex investments. For instance, if you own a reverse convertible note linked to the performance of a specific stock, you may be exposed to concentration risk if you also own the individual stock in a brokerage account. Similarly, you could own a mutual fund where the stock is one of the largest holdings.

If you think your portfolio may suffer from over concentration, talk to a financial professional, and take appropriate action to manage your risk. Concentration risk is real. The sooner you give your portfolio a concentration check-up the better.