As you prepare to invest, you’ll need to assess your net worth. It’s not hard: add up what you own and subtract what you owe. Creating a net worth statement, and updating it each year, will help you monitor your financial progress and meet financial goals. It will also enable you to calculate how much you have (or don’t have) to invest.

> Step 1: Determine the total amount of your assets. Assets are your possessions that have value. For example, money in bank accounts, stocks and bonds, personal property, your home or other real estate.

> Step 2: Determine the total amount of your liabilities. Liabilities are financial obligations, or debts. Examples include credit card balances, personal or auto loans and mortgages.

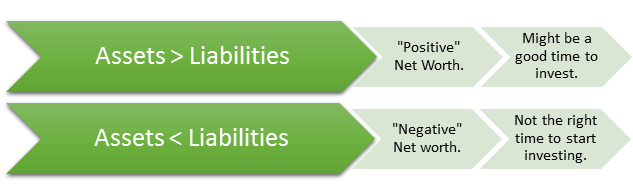

> Step 3: Subtract the total amount of liabilities from the total amount of assets. Ideally, you will want to have a greater amount of assets than liabilities.

Here’s a simple net worth worksheet that can help you get started. It’s a good practice to calculate your net worth on a yearly basis.